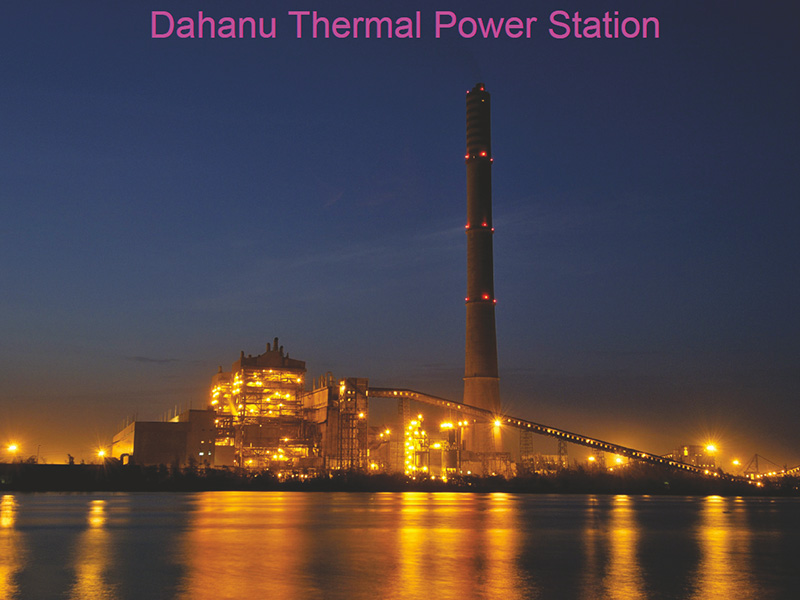

The deal includes the 500MW Dahanu power plant of Reliance Energy

November 17, 2015

Anil Ambani-led Reliance Infrastructure (RInfra) plans to sell 49 percent of its power generation, transmission and distribution businesses related to its Mumbai operations to Public Sector Pension Investment Board (PSP Investments), one of the largest pension fund managers in Canada, for an undisclosed amount.

R-Infra’s Reliance Energy, which distributes power to nearly 30 lakh consumers in Mumbai suburbs and had a revenue of Rs 7,700 crore in fiscal 2015, will be carved out into a separate entity in which the Canadian pension fund will buy the stake, a release from R-Infra said. In 2003, R-Infra had bought over the erstwhile BSES Ltd, which managed the power generation, transmission and distribution businesses in Mumbai suburbs and merged it with itself.

The latest deal is practically demerging the BSES’s businesses again. Sources say PSP Investments could pay anywhere around Rs 3,500 crore, valuing R-Infra’s Mumbai energy business at over 7,000 crore.

The deal includes the 500MW Dahanu power plant of Reliance Energy. Compared to the enterprise value of the deal for only the Mumbai business, which is pegged at Rs 15,000 crore, the market capitalization of R-Infra at Monday’s close was Rs 11,000 crore.

The two entities have sig ned an exclusivity agreement which is valid till March 31, 2016. “The proposed transaction is subject to due diligence, definitive documentation, applicable regulatory and other approvals and conditions. Accordingly , there can be no certainty that a transaction will result,” the release said.

The amount raised by RInfra will be used to retire part of its debt. Sources said of the Rs 16,000 crore debt that R-Infra currently has on its books, Rs 8,000 crore will be moved to Reliance Energy’s books. Post the deal, of the Rs 3,500 crore that R-Infra will get from the Canadian pension fund, Rs 3,000 crore will go to retire debt, bringing down the tota debt on R-Infra’s books to Rs 5,000 crore. This deal is part of R-Infra’s overall strategy to become debt-free by 2016. The company is also in the process of selling its cement and roads business. After the announce ment, the R-Infra stock on BSE rallied nearly 6% to close at Rs 418 in Monday’s relatively strong market.

R-Infra is one of the largest infrastructure companies in the country that is developing projects through various special purpose vehicles (SPVs) in segments like power, roads, metro rail, cement and defence.