Systematic Group aims to meet the evolving needs of industries like power transmission, telecom and infrastructure with high-strength and ultra-high-strength steel wires, OPGW and OFC. The first company in the country to manufacture Zinc Aluminum alloy coated wires, looks forward to sustainable growth with specialized wires for next-generation applications like smart grids, high-speed rail and renewable energy projects. This was revealed by Mr. Sidharth Agrawal, Managing Director of Systematic Group, during an exclusive interaction with Wire & Cable India.

Wire & Cable India: What are the current trends shaping the wire and cable industry in India, especially in the context of the steel wire sector?

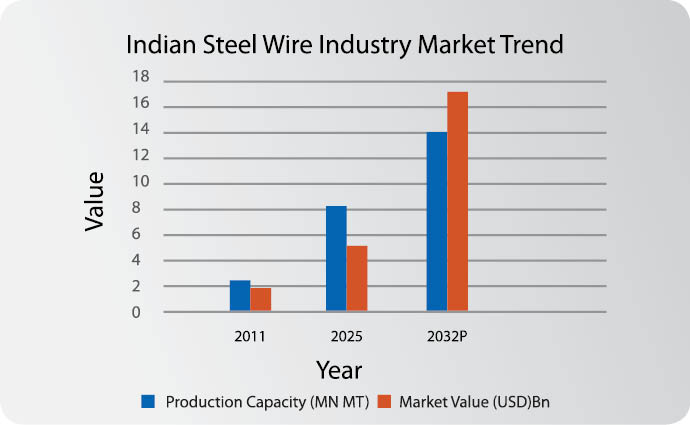

Sidharth Agrawal: Crude steel production for 2023-24 has continued growing, maintaining India’s position as the second-largest producer of steel globally. The steel wire sector is evolving with a strong focus on higher strength, better corrosion resistance and sustainability. Demand for high-strength and ultra-high-strength steel wires is increasing across industries like power transmission, infrastructure and security fencing.

We are also seeing a shift towards new-generation metals like stainless steel wires, which offer enhanced durability for specialized applications. Additionally, the demand for Low Relaxation Prestressed Concrete (LRPC) wires is growing due to increased infrastructure projects, including bridges, highways and metro rail networks.

Another emerging trend is the use of steel fibers in construction and tunnelling projects to enhance structural strength and durability. Zn+Al coated wires are becoming the preferred choice over regular galvanized wires because they last longer in harsh environments.

With government investments in infrastructure, renewable energy and rural electrification, the industry is poised for steady growth.

Watch: Top Cable Companies in India

WCI: How do you see the Budget for FY2025-26 impacting the steel wire and cable industry, and what opportunities do you think it offers for the sector?

SA: The budget’s impact will largely depend on allocations to infrastructure, power and agriculture as these sectors drive demand for steel wires. Increased government spending on power transmission, railway electrification and urban development will directly boost demand for high-strength and ultra-high-strength steel wires. Policies that support Make in India, domestic manufacturing and export promotion will further strengthen the industry.

Additionally, incentives for green energy and rural electrification could open up new opportunities for steel wire applications in solar and wind power projects.

Incentives for green energy and rural electrification could open up new opportunities for steel wire applications in solar and wind power projects.

WCI: How do you see Indian manufacturers competing with global players in terms of quality, pricing and technological advancements?

SA: Indian manufacturers are catching up fast. Companies like ours are investing in advanced coating technologies, high-strength materials and automated production processes to match global standards. In terms of pricing, India has an advantage due to cost-effective manufacturing and locally available raw materials. However, the focus is shifting from just pricing to value-added, long-lasting products like specialised coatings, stainless steel wires and ultra-high-strength wires, which reduce replacement and maintenance costs for customers.

WCI: Fluctuation in raw material prices has been a serious challenge for the steel industry. How do you plan to overcome the challenges? How do you see the industry adapting to these challenges?

SA: One of the biggest challenges for the wire industry remains obtaining wire rod at competitive prices. Due to trade barriers, we are forced to purchase wire rods at higher costs, which reduces the industry’s global competitiveness. Raw material price volatility is a reality, especially for metals, and with the current geopolitical landscape affecting supply chains and trade dynamics, price fluctuations have become even more unpredictable.

The companies can minimize scrap and enhance yield by going for process optimization and efficiency improvements. Cost fluctuations can be reduced through strategic sourcing and long-term supplier partnerships, along with product innovation. Overall, the industry is moving towards value-engineered products that balance cost, performance and longevity.

Also Read: Vividh Wires Makes a Headway in Specialty Wire with Its Second Manufacturing Facility

WCI: What are the recent developments and innovations happening at your company?

SA: We have been focusing on advancements in optical ground wires (OPGW), optical fiber cables (OFC) and aluminum clad steel (ACS) wires to meet the evolving needs of the power and telecom industries.

Our OPGW cables provide a dual advantage by ensuring lightning protection for power transmission lines and enabling high-speed data transmission through integrated optical fibers. With the increasing expansion of power infrastructure, the demand for durable and efficient OPGW solutions is rising. We are committed to delivering cables that offer high strength, corrosion resistance and long-term reliability.

In the telecom sector, we are strengthening our presence with OFCs, including printed OFC solutions, which not only ensure high-performance data transmission, but also provide customized branding options for clients.

WCI: Share with us your major projects, market footprint and clientele you are catering to.

SA: We cater to diverse industries, including power transmission, telecom, infrastructure and security. In the power sector, our wires are widely used for transmission & distribution, OPGW solutions and railway electrification, ensuring strength, durability and reliability. In telecom, we supply OFC and ACS wires, which play a crucial role in high-speed data transmission and network expansion. The infrastructure sector relies on our high-strength and ultra-high-strength steel wires for various major infra projects and construction applications, providing enhanced durability and safety. As a leading domestic supplier, we have built strong relationships with major players in these industries and expanded our global market presence to 30+ countries.

Overall, the industry is moving towards value-engineered products that balance cost, performance and longevity.

WCI: What are your future growth plans or investments aimed at strengthening your market position in the steel wire segment?

SA: Our growth strategy is focused on expanding capacity, investing in new technologies and developing innovative products to strengthen our market position. We are continuously working on new product development, especially in high-strength and ultra-high-strength steel wires, OPGW and OFC to meet the evolving needs of industries like power transmission, telecom and infrastructure.

We take pride in being the first company in India to introduce and produce Zinc Aluminum alloy coated wires under the brand GALVASYS, which offer superior corrosion resistance and durability.

In addition, we are strengthening our exports, leveraging our presence in 30+ countries to cater to a growing global demand for premium-quality steel wires. Our focus remains on collaborating with industry leaders to develop specialized wires for next-generation applications like smart grids, high-speed rail and renewable energy projects, ensuring that we stay ahead of industry trends, while delivering long-lasting and high-performance solutions to our customers.