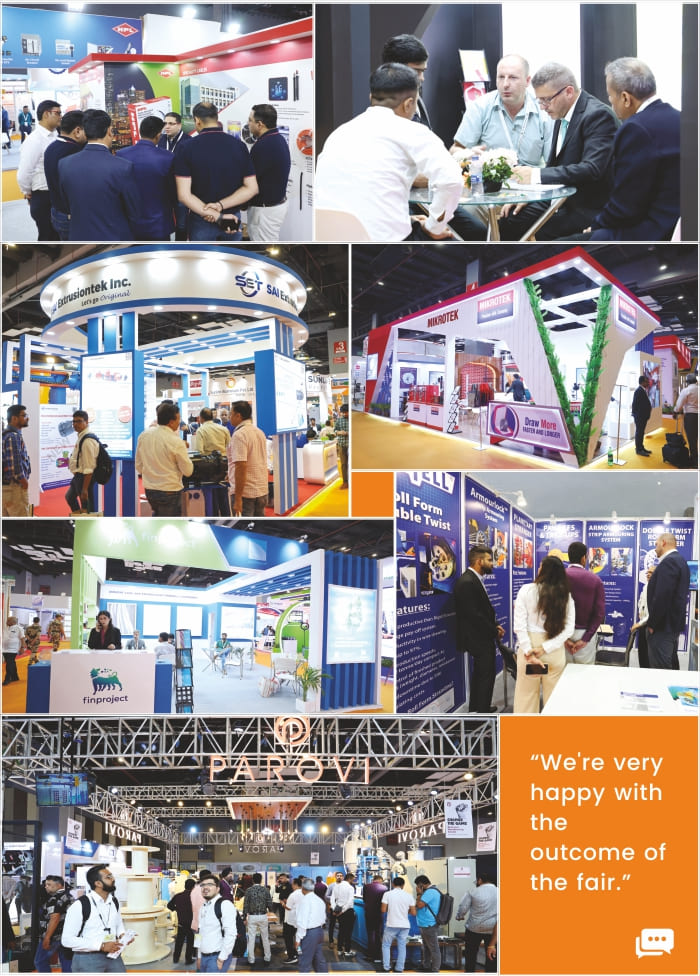

After a three-day run that threw light on the wire, cable, and allied industries, Cable & Wire Fair 2023 concluded successfully. Organized by Tulip 3P Media Private Limited, the International Exhibition & Conference for Wire & Cable Industry, after receiving an overwhelming response from the industry this year, showcased the products of around 350 exhibitors and registered a footfall of over 12000 visitors from Afghanistan, Algeria, Angola, Australia, Austria, Azerbaijan, Bahrain, Bangladesh, Canada, China, Democratic Republic of the Congo, Egypt, Ethiopia, France, Gaza Strip, Germany, Ghana, India, Italy, Iran, Japan, Kenya, Kuwait, Libya, Malaysia, Nepal, Nigeria, Oman, Poland, Qatar, Republic of Korea, Russia, Saudi Arabia, Singapore, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Thailand, The Netherlands, Uganda, United Arab Emirates, United Kingdom, United States, Zambia. The 5th edition of the Cable & Wire Fair (CWF) was held from 6th to 8th October 2023 at the newly constructed halls – Hall no. 2, 3, 4, & 6 at Pragati Maidan, New Delhi on a single platform of 250,000 square feet area, offering the best opportunities for networking & marketing of new technologies, latest products, and innovations in the wire and cable industry. Since its inception in 2015, CWF has steadily grown over the years with the current edition being 2.5 times bigger in 2023 than its fourth edition (CWF 2022). CWF 2023 earned high fanfare and appreciation by the industry.

CWF 2023’s esteemed partners included RR Kabel, Assomac Machines Limited, Supermac Industries India Limited, Sarvasv Machinery & Equipments Private Limited, Shakun Polymers Private Limited, Tomer Machines, Walson Woodburn Wire Die Private Limited, 3R Polymers Private Limited, and Niknam Chemicals Private Limited. The show was supported by the Cable & Wire Machinery Manufacturers Association of India (CMMAI), and the Steel Wire Manufacturers Association of India(SWMAI).

CWF 2023 also launched the 1st edition of Tube & Pipe Fair, an international B2B exhibition for the tubes and pipes industry, as its co-located event.

Meanwhile, the 2 -day Cable & Wire Fair Conference themed – “India: The Manufacturing Powerhouse of the World”, kick-started with the inaugural session addressed by key dignitaries – Mr. Anil Gupta, Chairman & Managing Director, KEI Industries Limited; Mr. Shreegopal Kabra, Managing Director of RR Kabel Limited and Group President of RR Global; Mr. Vijay Karia, Chairman & Managing Director, Ravin Group; Mr. Sidharth Agrawal, SWMAI- Chairman & Managing Director at Systematic Group; and Mr. Kamal Babu, Member – CMMAI.

High voltage deep dive discussions by the industry experts and leaders during the 2-day conference illuminated the atmosphere. Major highlights of the discussions were – Wire & Cable Industry: Ensuring A Sustainable Future; Wire & Cable Industry Outlook: Trends, Opportunities & Challenges; Telecom & Optical Fibre Cable Leadership Panel; Steel Wire Sector and Technical Session.

India: The Manufacturing Powerhouse of the World

Mr. Anil Gupta, Chairman-cum-Managing Director of KEI Industries Limited, delivered an inaugural address at the Cable & Wire Fair Conference, 2023. He began by expressing his gratitude for the opportunity and highlighted the significance of the wire and cable industry, which powers the modern world, “The Indian wire and cable industry, a crucial component of the nation’s infrastructure, is experiencing a notable transformation in recent years that has redefined the industry outlook. The electrical industry future in India is bright and sustained economic growth along with substantial investments in infrastructure by the government of India, state governments, and also the private sector, is going to drive the future of the Indian electrical industry, especially the wires and cables, which constitute over 40 percent of the electrical industry.” He discussed the global wire and cable industry’s worth, projecting a 5 percent CAGR over the next five to seven years, noting, “The global wires and cable industry is around USD 216 billion as of December 2022 and is likely to grow by around 5 percent CAGR over the next five to seven years.” Mr. Gupta emphasized that the Indian wire and cable industry is set to grow at a faster pace, approximately 14-15 percent CAGR, due to increased investments in infrastructure. Mr. Anil Gupta said, “In India, we expect that the Indian wire and cable industry should grow by 14 to 15 percent over the next five years because of the exponential investments in infrastructure and private capex that are now coming up in India.” He highlighted the industry’s focus on quality and certifications, as Indian companies are increasingly meeting the desired quality standards and certifications for overseas markets. He credited the acceptance of Indian products in developed countries, influenced by the ‘China Plus One’ policy, improved quality standards, and the scaling up of production infrastructure. In terms of market size, he stated that the industry is currently at INR 72,000 crore per year, with the expectation that it will double by 2027-2028 with a 15 percent CAGR growth. Mr. Gupta underlined the importance of quality certifications and advanced quality standards in the industry’s growth. He praised the Indian wire and cable industry’s technological advancements, manufacturing capabilities, and the ‘Make in India’ initiative. He said although foreign investment in the Indian cable industry remains limited, Indian companies are enhancing their quality standards through collaborations and investments in new machinery. Mr. Gupta also discussed the boom in the telecom sector, central government-led PLI schemes, and the role of Indian manufacturers in optical fiber systems. He emphasized that developments in power generation, solar distribution, and transmission infrastructure are key demand drivers. Mr. Anil Gupta articulated his company’s mission to lead with innovation, sustainability, and a commitment to excellence. He set the goal of increasing exports to 25-30 percent of sales in the next two to three years. KEI is dedicated to improving quality, service, lead times, and infrastructure to sustain its presence in international markets.

In terms of market size, he stated that the industry is currently at INR 72,000 crore per year, with the expectation that it will double by 2027-2028 with a 15 percent CAGR growth.

The speech of Mr. Shreegopal Kabra, Managing Director of RR Kabel Limited & Group President of RR Global, underscored the critical importance of trust, safety, and stringent regulations in the wire and cable industry. He called for a collective effort to ensure the highest standards and protect human lives. His words carried a passionate appeal for industry stakeholders and regulatory bodies to prioritize safety over profit, thereby fostering a safer electrical landscape for India. In his speech at the Cable & Wire Fair conference, Mr. Kabra emphasized the significance of the event on a global scale and shared his concerns about the wire and cable industry in India. He highlighted that, despite the presence of numerous multinational companies in various electrical sectors within India, the wire and cable industry has seen minimal foreign participation. Mr. Kabra questioned whether this was due to the industry’s immaturity or potential manipulation. He candidly stated, “I raised this subject yesterday in International Cable Foundation (ICF). Fortunately, I got this opportunity to represent IEEMA among the world’s top cable manufacturers and I told them about India’s growth story, how our country is growing, what is going to be in demand in India. I gave them examples of Siemens, Legrand and ABB, apart from companies from other countries such as Korea, which were doing well in India. I asked them, why don’t you come and invest in Indian wire and cable industry? It’s a really big question mark. And we know honestly what’s happening here, but except me, nobody dares to talk on this platform. I talk on every platform because I believe as a company, and as an Indian citizen, trust is the biggest thing in life. He stressed on the importance of trust and safety in this industry, recognizing that wire and cable products have a direct impact on human lives. Mr. Kabra lamented the alarming number of fire-related deaths in India and called for stronger regulations and standards. He urged the Bureau of Indian Standards (BIS) to conduct strict market assessments and address substandard products, even acknowledging that BIS standards are not always on par with global ones. Furthermore, he called for the improvement of a system where responsibility for substandard products is unclear, and where consultants and contractors sometimes escaped accountability. Mr. Kabra pointed out the need for a collaborative effort to bring about change, stating, “On every platform I am talking about stopping the use of PVC wire.” He cited Ireland as an example of progress in this regard, being the first country to entirely ban PVC wire in favor of low-smoke zero-halogen alternatives. He also noted the ongoing challenge of aligning Indian regulations with global standards, urging all stakeholders to work together to enhance the safety of the country and its citizens

He cited Ireland as an example of progress in this regard, being the first country to entirely ban PVC wire in favor of low-smoke zero-halogen alternatives.

Mr. Vijay Karia, Chairman & Managing Director of Ravin Group, celebrated the Indian wire and cable industry’s significant progress and innovation. He praised the industry’s ability to break away from global prototypes and create its own path, giving special mention to prominent players like Havells and Polycab. He acknowledged, “The growth that we are seeing in this industry is not following any particular model. We built our model & created our own path. And that’s commendable for this industry.” Mr. Karia emphasized the industry’s independence, highlighting the success of Indian manufacturers in high-voltage cables without foreign collaboration. He acknowledged and agreed with Mr. ShreeGopal Kabra on the critical issue of fire safety, which the industry is determined to address, given that electrical short circuits cause a high number of daily fires in India, noting, “I agree wholeheartedly with Mr. Kabra in the fact that there is an issue of fire safety and that’s something I think the industry will address because these issues are now being raised in various public forums time and again. There is an awareness coming around. Every day in India we lose about 74 lives due to fires, and 90 percent of these fires are caused due to electrical short circuits.” The speech reflected a shift in focus from mere profits to a broader vision of elevating India. Mr. Karia underscored the cable industry’s contribution to the electrical sector. He also pointed out the industry’s growing acceptance in international markets, a marked improvement over the past, the emergence of new product developments, polymer usage, enhanced safety measures, and specific applications. He said, “When we started exports in 1999, nobody used to buy Indian products. It was like Indian products, keep it aside. We went and started our first manufacturing venture outside India. Today, we see that Indian products are preferred products and there is no longer a trust deficit present.” This progress was seen as a reason for applause and optimism about the industry’s future, driven in part by the ‘Make in India’ initiative.

Mr. Sidharth Agrawal, Chairman of Steel Wire Manufacture Association of India (SWMAI) & Managing Director of Systematic Group, acknowledged the presence of industry veterans who have been a source of inspiration to him. He also acknowledged and agreed with the thoughts of the panelists, noting, “Mr. Anil Gupta emphasized the need to create and sell an Indian brand for the industry, while Mr. Gopal Kabra stressed on the importance of establishing an ecosystem for the industry. Mr. Vijay Karia encouraged setting their benchmarks and rules rather than following other countries or industries.” Mr. Agrawal introduced the SWMAI as the apex national body for steel wire and rope manufacturers in India. “SWMAI boasts a 60-year history, with a growing membership of 83 members and increasing figures annually. It is recognized by the Indian government and steel producers as a representative body, consulting with the Ministry of Steel on wire and rope industry matters.” The association has made significant progress in terms of volume, cost reduction, and quality to meet international standards. SWMAI is committed to research and development, collaborating with national and international organizations, and serving as a platform for communication between the government and the industry on various policies and issues. Mr. Agrawal highlighted the importance of securing a consistent supply of wire rods at adjustable prices in line with international rates, as well as favorable government policies to ensure the industry’s sustainable growth and global competitiveness. SWMAI actively engaged with the government to address these concerns and played a pivotal role in the development of the PLI scheme for the wire industry. The association’s vision is to position India as a global preferred supplier of steel wire through innovative technology, sustainability, and reduced carbon footprint. They aim to make India the preferred choice on the global stage.

Mr. Batchu Kamal Babu, Member of Cable & Wire Machinery Manufacturer Association of India (CMMAI), Founder & Managing Director of Mikrotek Machines Limited, highlighted the significant growth of the wire and cable industry, particularly the copper industry, in India over the past decade, and contrasted this with a decline in China and sluggish growth in Europe due to the Ukraine war, “The latest statistics say that: the Chinese industry is going downwards at 3 percent, Europe is very sluggish due to the Ukraine war, and only India and America, on the global front, are doing at their best times in the last 10-15 years. India is growing and doing exceedingly well, and is expected to continue for the next 10 years.” He further emphasized India’s enormous potential for further growth, particularly in infrastructure development, and the need for the machinery industry to cater to this demand. He highlighted that apart from construction various other aspects also have huge potential and demand investments from the wire and cable industry, and machinery and equipment manufacturers. He further highlighted how the Indian machinery manufacturers are leveling up, “In the past, though we had many machinery suppliers in India, the majority used to bring technology from Europe, USA, and equipment from the USA, Europe, and China. I have seen my company export to more than 40 countries for the past 30 years, 50 percent of my exports go to Europe and the USA. Earlier, American companies used to possess capacity, but today our expansion in India is at the same rate. We need to accelerate this rate.” CMMAI was established in 2019, as a group of companies, to bridge the gap in the Indian wire and cable industry by offering machinery and technology locally, stressing the importance of gearing up to meet the industry’s evolving needs. CMMAI’s efforts include providing training and necessary technology to the industry. Mr. Batchu also mentioned regular meetings and discussions to address the sector’s challenges and proposed inviting customers from neighboring countries to facilitate joint ventures and collaborations, potentially boosting wire and cable industry exports from India. Acknowledging Mr. Priyank Jain’s journey and efforts, Mr. Batchu presented the success indicators of the CWF 2023, and WCI, “I have known Mr. Priyank Jain for many years. He started his business in 2006, but in the past 10 years, he has grown by leaps and bounds, bringing CWF to a greater stance. This is the fifth exhibition in a row, with more than 350 exhibitors. His magazine, Wire & Cable India is very popular and has more than 20,000 subscriptions. We advertise in almost every edition of WCI. Whichever company, in whichever corner of the world, I go to I see WCI. It’s a great success;” he appreciated Mr. Jain’s achievements and wished him continued success. Further supporting the idea of setting up an R&D Center, presented earlier by Mr. Kabra and Mr. Karia, he highlighted the need for automation and high-quality production, towards which the center could foster collaboration with industry leaders and sought involvement of young Indian engineers. He asked for a collaborative commitment from industry leaders alongside CMMAI and urged Mr. Jain to take the lead in realizing the vision for the R&D center. Mr. Batchu’s speech effectively presented the industry’s growth, and further need for local innovation and collaboration to meet the demands of a rapidly expanding market.

Mr. Priyank Jain, Chief Executive Officer of Tulip 3P Media, presented mementos to the designated inaugural speakers followed by a vote of thanks, “Respected Anil Gupta ji, Shreegopal Kabra ji, Vijay Karia ji, Sidharth Agrawal ji, Kamal Babu ji, conference speakers, exhibitors, partners, delegates, invitees, and friends from the industry; I would like to thank you all for your support in making Cable & Wire Fair a successful event. My special thanks to the Tulip team and the crew, who have worked un-tiringly to make this event a success. I’m happy to share with you all – this year the show has grown 2.5 times, covering an exhibition area of 250,000 square feet across four halls. This could happen because of the support of the industry, because of my mentors on and off the stage, and because the industry is growing, and India is growing. I am also happy to announce that we have launched a co-located event this time, Tube and Pipe Fair.” He further addressed the core theme of the conference and CWF 2023, “The theme of this year’s conference, ‘India the Manufacturing Powerhouse’, is very well aligned with the increasing importance of India as a global manufacturing hub, as all of these speakers have mentioned in their speeches. I have observed that the most important aspect is how exports of the Indian wire and cable companies are growing exponentially – Anil Sir just shared great targets for his company to increase the exports – and we see that is happening with various wire and cable companies, not just large-scale but also the medium-scale ones, which is a very good thing. Hope you all have a good three days of networking and knowledge sharing, and this event acts as a good catalyst for the industry. Thank you!”

Wire & Cable Industry – Ensuring a Sustainable Future

Mr. Rohit Pathak, Chief Executive Officer of Birla Copper (Hindalco Industries Limited), delivered a powerful message about the enormous opportunities for the cable and wire industry in India and the need to focus on quality, sustainability, and innovation to seize these opportunities and build a better future. He highlighted that India is in a favorable position globally, with growing geopolitical importance and a significant portion of the world’s working-age population coming from the country. This positions India as a potential supplier of talent and products to the world, “This is India’s decade. The geopolitics have put India in a fantastic space globally, with the US and Europe looking for alternatives to China. It’s not about replacing China but it’s about taking some part of that business away in the diversification. India will be the best country in the next 20-25 years with almost 30% of the world’s working-age population coming from India. So in the next 20-25 years we will be the supplier of talent for India and the rest of the world, and the challenge for all of us as the industry is to keep the talent in India to make products for the world and not just export talent.” He emphasized the increasing importance of electricity, stating that it will play a core role in India’s development. This transition to electricity-driven solutions is a significant opportunity for the cable and wire industry. He further asked the industry to focus on three stages – Make in India, Made in India, and Imagine in India, “In the next 7 to 10 years, India will add as much electricity as we have done in our history so far over the 75 years, and 75 percent will be green electricity. The onus is on us as an industry to build it right. We don’t want to build something that every five years you have to replace and change, so let’s focus on the growth and not on the short-term potential. Hence, the focus is on three stages – Make in India; Made in India, the transition is already happening; and the third one, which I feel is even more important, Imagine in India, which we need to think of solutions for India, which can then be taken to rest of the world. This shift from Make in India to Made in India to Imagine in India is an important priority;” he mentioned the need to continue making products in India for the domestic market, stressed the importance of transitioning to “Made in India” products for global markets, emphasizing the potential for exports, and urged the industry to focus on creating innovative solutions that are designed for India’s unique needs and can be taken to the global stage. He also listed quality, sustainability, and innovation as the priorities for the Industry. According to Mr. Pathak, a strong emphasis on quality, suggesting that it’s crucial for long-term success, both in serving the Indian consumer and gaining trust in international markets must be laid. He discussed sustainability from the perspectives of sustainable value chains, recycling, and creating long-lasting products that minimize waste. He further encouraged the industry to collaborate with the startup ecosystem for R&D and innovation, emphasizing that it can provide cost-effective and efficient solutions, “The Indian consumer told more than 10 years ago that I want quality, a good product, I don’t want just a cost-effective product. If you are willing to give it to me, I will pay for it. I think that narrative can be changed. We are still stuck in the narrative of reducing cost – let me reduce the material, reduce the specs, and fight on price, but no country has and no sector has ever won only on price. The product has to be upgraded, it has to be better quality, and then you can optimize price but not the other way around. We are building India, let’s build it right. You don’t get often this chance as a generation to build the country, let’s do justice to it so that when we look back, we say – we built a good country, we built a good infrastructure that will serve 30, 40, 50 years. Three parts of sustainability – sustainable value chains, something that will last the next 10, 15, and 20 years, and not go away because of wrong practices; recycling, we have to design products that can be recycled; and innovation, built-in the country is great startup innovation culture that is beginning to take roots, we can create a system where the startup ecosystem can plug into our companies to do R&D a lot more effectively, efficiently, and at a lot lower cost than traditional R&D.”

Mr. Manjit Singh, Executive Director of KEC International Limited, discussed the significance of the cable and wire industry in India’s growth story. He began by commending the event’s organizer, Mr. Priyank, for promoting the industry through exhibitions and conferences. He emphasized the industry’s impressive growth rate, outpacing global competitors, and credited its domestic-led nature as a testament to its credibility. He pointed out that cables and wires are vital for various sectors, including infrastructure, industry expansion, roads, EVs, and data centers. He highlighted India’s growing energy demand and the need for high-quality products, “The wire and cable industry is an important and integral part of India’s growth story. This industry has been outpacing even the external market – the other countries have a growing rate of 5-6%, but India has been growing at 13-15%. India’s growth story is hinged around a few things. A lot of capex is being put in by the government and private sector. As the people of India are growing, their demands for energy and per capita consumption also is growing. So there is a very good future for the cable and wire industry for the next five to 10 years.” Mr. Singh noted India’s transition to a USD 5 trillion economy and its role in the global market, especially in exports. He stressed the importance of improving quality and safety standards, both domestically and in exports, to compete effectively, “All the industries have to play important roles, including the cable and wire industry. In the last few years, we have seen a tremendous improvement in the manufacturing processes, and in the R&D side. There have been a lot of improvements, like in the EHV technology. Also with the improvement in the quality, there has been a lot of spurge actually in the exports. All the major manufacturers of cable and wire are going for exports. If we can supply to countries, like the US, where quality and safety are very important. So if we are exporting to those countries, it’s a fact that we have improved on the quality front. We need to work on the domestic side also to improve. We go by price and manufacture accordingly, that trend needs to change because safety and quality are equally important in our country.” He acknowledged the need for talent in design, manufacturing, and R&D within the industry, urging to prevent brain drain by retaining skilled individuals in the country, “The industry is expanding at the rate of 13-15%, we require huge talent in the design side, from the manufacturing side, from the R&D side. 25% of the engineering graduates of the world come from India. We need to take advantage because a lot of people are going out with the knowledge they take from the country. So that brain drain we need to stop and try to see that the best of the drains are in the country.” He praised the world’s acceptance of Indian products during times of global supply disruption. Mr. Singh recognized the industry’s responsibility in ensuring safety and concluded by emphasizing the importance of innovation and adopting AI for sustainable growth in the cable and wire sector, “The world has adapted and accepted India with open arms. While I appreciate exports, a lot needs to be done to improve domestically on the quality and cost so that we are very competitive on the global side. For the sustainable growth of our country, cable and wire needs to play a very important role. We need to do a lot of innovations. AI is the future, so we need to see how we can leverage it so that we can take advantage of the cost side, and quality side, and improve on the productivity side. We all need to see all the stalls in the exhibition because in the morning I saw a lot of new manufacturers, with new technologies. We must appreciate the new technologies that are coming up and try to see that we imbibe actually in our cable and wire growth story.”

Mr. Benoit Lecuyer, Chief Executive Officer of Prysmian India & ACPL, has 18 years of experience working in India for companies, like Legrand, Hager, and Prysmian. In his speech, Mr. Lecuyer expressed his gratitude to the organizers of the event and emphasized the importance of sustainability. He discussed the global impact of climate change, particularly the consequences of a 1.5-degree Celsius temperature increase, such as rising sea levels and natural disasters, “Sustainability is an imperative. I discuss and engage in a lot of universities; the XZ generation reminds us how important it is to preserve the planet, and not consume more than what we can produce. An increase of 1.5 degrees which we are experiencing now, we may think that’s not so important but during the past 4-5 years – massive floods, massive fires, massive earthquakes happening throughout the world, increase in temperature made a consequence of the ice melt at Antarctica, sea level will increase by six meters, Indonesia has engaged the capital Jakarta to move in Java, and Egypt, Cairo, the new capital, will be built in another town because every year they have massive floods.” He highlighted the role of the cable industry in promoting sustainability. Mr. Lecuyer underlined the need for India to harness its renewable energy potential, such as wind and solar power, and the importance of the cable industry in supporting these developments. He also stressed the significance of expanding access to electricity and fast internet, particularly in India, and the role cables play in achieving this, “Prysmian worldwide, and in India, – decarbonization we have started many years ago and engage in all the departments, either manufacturing, resource logistics, human resource, R&D, and a lot of tangible and measurable efforts to engage in sustainability. What can be the role of the cable industry in sustainability? Well, it’s massive, for example, India is blessed with 43 GB of renewable energy wind, and 70 GB of solar. In Tamil Nadu and Gujarat, the Indian government, with the help of foreign institutions will engage in a lot of offshore wind farms and onshore wind farms. It will be a huge opportunity for submarine cables. A social commitment to sustainability, many people still don’t have access to electricity, to get it they will need cables. Also, with access to fast internet, we are blessed in our industry that both energy, electrical cables, and telecom, CAT7, and CAT8 optical fiber cables are working in concert. We have the chance in Prysmian to be present in both big segments because to make massive energy more reliant, we need to measure, assess, monitor, send a lot of data for maintenance, and all this requires IoT, object connected;” Grid hardening and digitalization were identified as areas where the cable industry could contribute to sustainability, “World needs much more electricity, but electricity is transported from generation to distribution through the grid, and worldwide there is a massive need for grid hardening, which means maintenance and uplifting of the grid, and a new grid to conduct and distribute electricity. So in the next 50 years, a super opportunity for the cable industry. Digitalization – today, the world is extremely greedy, and the number of kilometers in CAT7 optical fiber is massive.” The speaker discussed the company’s commitment to sustainability, with a focus on reducing its carbon footprint and promoting recycling. He emphasized the need for innovation in the industry, with examples such as P-Laser cables and Alésia’s smart drum technology. Mr. Lecuyer pointed out that Prysmian’s efforts in sustainability are measured through key performance indicators (KPIs) and reported through various international organizations’ standards, highlighting the importance of transparency and accountability in these efforts. Furthermore, social responsibility was emphasized, including equal opportunities for employees regardless of their background. Mr. Lecuyer also mentioned Prysmian’s program, “Build the Future,” which brings in young engineers to work in various subsidiaries and promotes diversity and inclusion, “For Prysmian, sustainability started many years ago. We put in place very precise KPIs. We are engaged to eliminate scope one and two, which is under our control because scope one is what we consume and what we deliberately throw to nature; scope two is what we buy from the energy suppliers, so we will be net zero hopefully by 2035 and 2050. The most difficult part is scope three – what our clients and suppliers are doing. We have engaged with our Indian clients, suppliers, also worldwide, and with a very strong partnership between India and Europe, we help our suppliers mutually engage in recycling sustainability. Sustainability social element – diversity, inclusion, regardless of age, young or mature, regardless of religion, and access to jobs for disabled people. Sustainability can be achieved thanks to innovation. EcoCable, P-Laser.” In conclusion, Mr. Benoit Lecuyer highlighted the urgent need for sustainability and the cable industry’s pivotal role in achieving it. He shared insights into Prysmian’s sustainability initiatives and their impact on India and the world.

Mr. V K Bajaj, Senior President – Business Strategy & Innovation at Apar Industries Limited, expressed his gratitude for being invited to the event and commended the Cable Wire team for their excellent work. He highlighted the growing importance of sustainability, particularly in the context of ESG (Environmental, Social, Governance) practices. Mr. Bajaj discussed the significant impact of carbon emissions and greenhouse gases (GHGs) on climate change. He explained that GHGs, such as carbon dioxide, methane, nitrous oxide, and hydrofluorocarbons, contribute to global warming and its adverse effects on the planet. Mr. Bajaj stressed the need to understand the greenhouse effect, which leads to global warming and climate change, and how human actions like industrialization contribute to this phenomenon. He explained the classification of GHG emissions into three scopes, with a focus on scope three emissions, which includes the embedded carbon footprint in raw materials like aluminum, used in the cable industry, “The effects which are happening on the planet because of the greenhouse gases are climate change. GHG emissions are classified into three scopes – direct emission which is happening from the operations in the industry; scope 2 is indirect emission from the purchased electricity; and all other emissions are classified under scope 3. The most important is embedded in the raw materials because you are not producing raw materials, you are buying raw materials. People who are producing raw material for you are also consuming energy.” He emphasized the emerging trend of carbon labeling for products and the implementation of carbon border adjustment taxes in some regions. The speaker underlined the importance of reducing carbon intensity, which refers to the amount of carbon emissions per ton of cable produced. He encouraged the industry to adopt low-carbon raw materials and products and use carbon-friendly materials to meet the increasing demand for such products, “In Europe from 1st of January, 2026, you have to label all your cable products or other products of how much carbon has been consumed in that product. They will put extra import duty other than the conventional duty, carbon border adjustment tax, so you are also exporting carbon that you have used to that country, so they are going to put tax depending on how much carbon it is. So, our industry needs to start understanding this because in the next 2-3 years time, and as responsible industry members, we all have to work in the direction of reducing the carbon emission in the overall system.” Mr. Bajaj also pointed out the significance of employee engagement, reduction of industrial gas emissions, business travel optimization, and the shift towards remote work to lower carbon footprints. Mr. Bajaj shared his company’s efforts in analyzing the carbon footprint of their business, including scope one and two emissions, and their ongoing work to address scope three emissions. He emphasized the need for third-party verification of GHG emissions and highlighted the importance of employee engagement, “Verification of GHG emission by third party auditors; it is not that we internally said we have reduced the carbon emission, it is audited by a third party, otherwise, the customer will not accept that you have reduced the carbon footprint.” He also mentioned that their ESG (Environmental, Social, Governance) reports, including carbon emission data, are available on their website as a reference for others in the cable industry. In conclusion, Mr. V K Bajaj underscored the urgent need for the cable industry to address carbon emissions and GHGs, work towards reducing their carbon intensity, and embrace sustainability practices for the future, “Reference wise we have three businesses – oil, cable, and conductor, so how much emission over the last three financial years; In the oil business, we have been able to reduce significantly, but in the cable and conductor, which is comprising of significant part aluminum and we cannot help it, so our volume it is increasing, but the intensity is coming down, that means per ton of cable in 2021 this much of aluminum per so carbon emission, after two years it has reduced by 25 percent;” he encouraged industry members to study and learn from ESG reports and take steps to reduce their carbon footprint.

Wire & Cable Industry Outlook – Trends, Opportunities, & Challenges

Mr. Anurag Agarwal, Executive President – Strategic Initiatives & International Businesses at Polycab India Limited, delivered an insightful speech discussing the dynamic landscape of the cable manufacturing industry. He began by highlighting the promising prospects for the Indian cable industry, with growing global demand and India being viewed as a favorable manufacturing destination under the “China plus” policy. He stressed the role of advanced technology transfer in servicing the Indian market and expected double-digit growth in exports from India. Mr. Agarwal pointed out that the global demand for wire and cable is projected to surge from USD 250 billion to USD 410 billion by 2030. Renewable energy emerged as a major driver of this demand, accounting for nearly half of the cable demand. He emphasized the tremendous growth in government infrastructure spending, real estate, data centers, and power generation driven by renewable energy. The aerospace and defense sector in India is expanding, with the country becoming an export hub, “Indian industry is on the cusp of a wonderful scenario wherein the entire globe is watching us now. We see further more and more business growth, for exports from India are going to grow. The growth of the export market is certainly going to be double-digit for all cable industries. Currently, the overall demand globally for wire and cable is approximately USD 250 billion per annum, and we are very clearly visualizing that this is going to grow to USD 410 billion by 2030. The biggest demand for the wire and cable industry is coming from the renewable industry, followed by oil and gas, transmission and distribution, up-gradation, large-scale infra projects, and offshore project requirements. India is still a small market, in terms of exports, so a lot of potential is there for India. Fortunately, infrastructure in India is at its peak and we are seeing wonderful demand coming in from the government. The push from the government is exceptional, be it renewable, infra, bridges, or railways. Further, when we talk of power generation and distribution, there is a tremendous growth of 8.87% as compared to 2021-22, this trend is going to continue because global demand for renewable energy will go from 1TW to 6TW by 2030. The aerospace and defense – industry as well as the ministry has done a tremendous job in bringing a lot of manufacturers into India from the UK, and the US, and a lot of manufacturers have collaborated with Indian companies and set up manufacturing plants in India. India is going to become an export hub. Further, offshore and wind, something still not very dominant in India, but Germany has 70 GW of offshore wind targets. So Indian diaspora is also working on this segment, this is another big opportunity that is going to come;” the transportation industry, particularly locomotives, is on the rise, with Indian coaches being exported globally. Mr. Agarwal highlighted the increased focus on safety and security, along with the adoption of greener and cleaner cable life cycles. He also discussed emerging cable technologies such as superconducting, hybrid cables for smart cities, and recyclable PP insulation. The growth of electric vehicles (EVs) is expected to gain significant momentum by 2030. Additionally, the development of polymers made from vegetables is an innovative area to watch. Mr. Agarwal emphasized the shift towards higher voltage cables, from 220 kV to 550 kV, and the transition from HVAC to HVDC technology, which is gaining traction globally. However, he noted that Indian manufacturers have yet to enter the HVDC market but expressed confidence that they would do so soon. One of the major challenges he discussed was the need for India to enter the submarine cable manufacturing sector, a highly specialized and costly field, which would require government support. This is vital for island interconnects and long-distance power transmission. He concluded, “Change is the only permanent thing in the world, more so, technology change, and adaptability to change is a simple secret of growth and survival.”

Mr. Nikhil Bhagchandani, Deputy Director – Marketing, Aluminium Business at Vedanta Limited, delivered a speech highlighting Vedanta’s role in the Indian aluminium industry and its focus on supporting the electrical sector, which he referred to as a golden era. Vedanta is India’s largest diversified natural resources company with a substantial presence in aluminium production, covering the entire value chain from bauxite mining to finished goods. Mr. Bhagchandani emphasized India’s growing demand for aluminium, estimating consumption to exceed 5 million tons in the coming years, with the electrical sector expected to be a significant growth driver, particularly for wire rods used in cable and conductor manufacturing. He discussed the need for Indian manufacturers to expand their capacities, especially in areas like submarine cables where India currently lacks production capabilities, “Industry should invest more, and increase their production, and India can also become a sustainable supplier of everything that is required in the world and not just in the country’s growing demand. Focusing on the country’s growing demand, we see that the Indian market outlook is very positive and from the current consumption levels, we see that it is going to cross the total consumption of aluminiumh by more than 5 million tons in the coming years. The need for the right cables and the right conductors in setting up all the infrastructure investment is required. This is the golden era for the electrical industry, and we are here to support whatever is required by this industry. Some of the cables, submarine cables, which are probably not being made in India right now, also require effort. End-to-end accountability of the material is equally important, along with the quality parameters.” Mr. Bhagchandani highlighted the importance of quality standards and traceability throughout the supply chain, aligning with international standards such as ASTM and EN to ensure Indian products meet global expectations. He noted that efforts are underway to align with the Bureau of Indian Standards (BIS) to enhance product quality and consistency. Vedanta’s role in this context was emphasized, with the company positioning itself as a leading supplier of wire rods, including EC rods and alloy rods, to meet the specific requirements of the industry. They focus on product customization to cater to the individual needs of downstream partners. Mr. Bhagchandani also introduced Vedanta’s new eight-series alloy wire rods, specially designed for marine applications and better conductivity, along with T4 and AL-59 alloy rods customized for the conductor industry. Environmental responsibility was another key theme in Mr. Bhagchandani’s speech, with Vedanta launching green aluminium brands, Restora and Restora Ultra. These brands are produced using renewable energy and recyclable materials to reduce carbon footprint, to ensure low greenhouse gas emissions per metric ton of aluminium. This initiative aligns with industry-wide efforts to promote sustainability. In conclusion, Mr. Bhagchandani expressed his gratitude to the forum and highlighted the importance of collaboration, “I hope that more and more products, and processes can be improved with the close coordination of all the industry partners and the primary producers;” to further enhance product quality, processes, and environmental sustainability in the aluminium industry.

Mr. Sandeep Aggarwal, Managing Director & Promoter of Paramount Communications Limited, addressed the trends, opportunities, and challenges in the cable industry, particularly in the context of India’s growing significance. He emphasized that India is the trending focus, positioned as a promising destination for manufacturing and trade. However, he brought attention to the challenges that come alongside these opportunities. One significant challenge is the criteria for experience and certifications in specific areas, particularly within the subsea power sector. Mr. Aggarwal highlighted the need for a more flexible approach, recognizing that new Indian companies cannot have 10 or 20 years of experience in these emerging areas. He stressed the importance of collaborating with the government to address these technical challenges and align regulations to facilitate market entry and growth. While acknowledging these challenges, he pointed out that the market opportunities in the cable sector are substantial, estimating it to be a USD 200 to USD 250 billion industry globally. India’s current share in this market is only around 4 percent, indicating significant room for expansion, Subsea cables – there is a huge requirement, but what about the technical possibilities, need to have 10-20 years of experience, that is the problem. So, we need to work harder and together in working out a solution. There is an opportunity, I was considering maybe the copper, and aluminum cable sector as $ 200 billion, but if I include optical fiber, the international market would be $250 billion – what is India doing; $10 billion – 4 % of that.” Mr. Aggarwal touched upon the complexity of maintaining high-quality European standards while being cost-competitive and navigating factors like carbon taxes. He emphasized the importance of delivering European-quality products at Indian prices while maintaining high standards and working together as an industry to overcome these challenges. Mr. Aggarwal expressed confidence in the Indian cable industry’s potential to lead globally over the next decade, provided they prioritize product quality. He urged the industry to collaborate and collectively ensure that the brand India is not compromised, emphasizing that unity and a commitment to quality are essential for sustainable growth, “The customer needs European quality at an Indian price but with a carbon tax. The industry needs to work together and individually, and I hope that the industry will have an industry meeting on this issue again, and ensure that the brand India does not suffer.”

Mr. Naveen Sawhney, Chairman & Managing Director of Cords Cable Industries, delivered a speech focusing on the wire and cable sector, highlighting its journey from a manual labor-intensive industry with limited demand in the 1960s to its current position in the global market. He discussed the substantial growth in the sector, driven by government initiatives like Subhagya, Power for All, and rural electrification, which have increased demand for wires and cables, particularly in rural areas and transmission and distribution projects, “In the early 1960s, the industry was characterized by limited demand, manual labor-intensive processes, minimal automation, and lack of technology, there were only a few players for cables and wires. Fast forward to the 1990s and beyond, when the Indian economy started opening up to foreign investments leading to increased capital infusion in various sectors this gave a sudden bolt of energy to our cable industry and we started witnessing significantly raised demand resulting in capacity expansion and entry of new players into the industry. In 1960, a typical thermal power project used to consist of 2-3 units, each of 30/40/60 MW; early 1980s, the first unit of 200 MW was commissioned and it took around 40-56 months to commission it; moving forward from 2015 onwards, size of unit from 200 MW initially from 30-40 MW to 200 MW and 800 MW with supercritical boilers, all these units are expected to get commissioned within 30 months. Government initiatives are like the superchargers of our industry. This has accelerated the demand for wires and cables, especially in rural electrification, transmission, and distribution projects.” He also noted that renewable energy, green ammonia, and green hydrogen present significant business opportunities for the industry. Mr. Sawhney emphasized the potential for electrification of transportation, electric vehicles (EVs), and e-mobility infrastructure, highlighting the growth in charging stations and the transformation of fuel stations into EV charging hubs, “We should consider ourselves blessed to be a part of this era of exciting journey, coming at a very fast pace. Our country is working expeditiously to become a major player. Let us be ready to grab these huge business opportunities. Electrification of transportation, EVs, and e-mobility infrastructure is another upcoming sector. There has been a thrust on the electrification of transportation resulting in the rise of electric vehicles and the development of e-mobility infrastructure. Charging stations coupled with wires and cables are going to become the new face of our full fuel station. The fuel station which we are having I think soon, maybe another six months or one year.” He also recognized the industry’s progress in generating global confidence, with international companies seeking Indian cable suppliers and the need for constant upgrades in manufacturing facilities, quality standards, and sustainability to meet global demands. Looking forward, Mr. Sawhney encouraged the industry to invest in research and development and embrace automation, innovation, and Industry 4.0, which can enhance production processes, improve efficiency, enable predictive maintenance, and support the customization of cables. He emphasized the importance of embracing innovation, maintaining high standards, and adaptability to sustain industry growth. Mr. Sawhney also shared anecdotes about the industry’s journey, from initial hesitancy to accepting Indian cable suppliers in the global market, showcasing India’s competitiveness and product quality. He concluded, “We have come to a stage where I am confident our industry can meet the challenges that are there for us, challenges of grabbing, you see, a substantial portion of the demand, global demand, which is available with us;” emphasizing the industry’s readiness to meet the challenges of global demand and remain competitive in the evolving landscape.

Mr. Manish Srivastava, Director & Head of Power Cables – Global Products & Services, Sterlite Power, highlighted the promising prospects and significant opportunities for the wire and cable industry in India. He began by acknowledging India’s position as a rapidly growing economy, poised to become the third-largest globally. He emphasized the integral role that the transmission and distribution sector plays in driving economic growth, indicating an expected investment of 1 to 2 lakh crore in the next two years. He also pointed out the substantial expansion in the generation sector, with 800 gigawatts of installed capacity projected by 2030, a significant portion of which (500 gigawatts) will be contributed by renewable energy, driving investments worth USD 30 billion, “In the transmission sector, we see an investment of 1-2 lakh crore in the next two years. In generation, the total installed capacity would be in the range of 800 GW by 2030, and out of this, 500 GW would come from renewable. This amounts to a 30 billion dollar investment in the renewable sector, which could be a fast driver of cable industry growth as well. Apart from this, there are major growth sectors where the cable industry can contribute like 5 billion dollar investment is expected in data centers year after year for the next decades. We have an ambition of 100 smart cities in the first phase, out of 166 smart cities. These kinds of things are throwing a lot of requirements apart from EV charging, and urbanization. Per capita energy consumption by an Indian is almost one-third of the global, and once we go for a better system of living, more urbanization, and industrialization, the cost of energy would go up and innovation would also come into the picture. So railway and metro would also be a kind of growth sector. The speed at which we are growing today will be 3.7x in the next two years. Growth is outpacing our ambition and our expectations;” furthermore, Mr. Srivastava identified various emerging growth sectors where the cable industry can make substantial contributions. These include data centers, smart cities, EV charging infrastructure, urbanization, and rail transportation, with the railway sector expected to grow at an impressive rate of 3.7 times in the next two years. He emphasized the need for industry players to align with decarbonization efforts, considering India’s relatively low per capita energy consumption and the inevitable surge in energy demand as the country undergoes urbanization and industrialization. In addressing the challenges that lie ahead, Mr. Srivastava discussed the importance of synchronous growth in the value chain to avoid imbalances, given the various segments within the industry, “China plus One has been talked about, but I would say the strategy is second to China, so why not have India’s strategy along with the China plus One strategy? We will have our strategy which will be super leading China plus one strategy in the wires and cables field.” He also pointed out challenges related to commodity price fluctuations, the need for standardization in the cable sector, and the critical requirement for a skilled workforce to support industry growth. He urged a proactive approach to skill development and the collaboration between industry players, universities, and the government to address these challenges effectively. In closing, he underlined the cable industry’s unique role in providing solutions to critical challenges, positioning it as a solution-driven industry rather than just a manufacturing one, “If INR 100 is spent on electrical equipment buying, INR 37-36 goes towards cable. So one-third of the total industry is represented by people sitting here in this room. We are in a great place at a great time. Let us work together to achieve our entire potential by working together as an industry and collaborating, innovating, and also taking care of the challenges of the future.”

Telecom & Optical Fibre Cable Leadership Panel

Mr. R Sridharan, Chief Executive Officer of Birla Cable Limited, in his speech at the CWF 2023 discussed various facets of the telecom and optical fiber cable industry, both in India and on a global scale. He began by highlighting the significant government initiatives driving the optical fiber cable sector, such as the Digital India Initiative, Bharatnet program, and the National Broadband Mission, which aim to connect rural areas and provide essential services to the rural population. These initiatives are seen as promising drivers of long-term growth for the industry, mitigating the cyclic ups and downs it often faces. He delved into the details of the Bharatnet program, its progress, and plans to expand optical fiber coverage. He emphasized the substantial investment and increasing optical fiber deployment across the country. He also pointed out the need for digitalized mapping of communication infrastructure to prevent disruptions due to digging for various utilities, “The government of India has an ambitious plan, which is the Digital India Initiative, the Bharatnet program, and the national broadband mission. Together, that is going to drive the telecom industry from the government side giving a promising road ahead for the optical fiber cable industry. The Bharatnet program, started by the government of India in 2011, was originally under the name of National Optical Fiber Network, NOFN, and was renamed Bharatnet in the year 2015. It was to provide connectivity to 2.5 lakh gram panchayats through optical fiber cables and facilitate the delivery of e-governance, e-health, e-education, e-banking, internet, and other services for the rural population of the country. In cities, we have very good development in terms of connectivity, but in rural India, it is still lacking. This flagship mission was to be implemented by Bharat Broadband Network Limited (BBNL) and subsequently merged in 2022 with BSNL. This entire project is to provide affordable broadband connectivity to all the rural masses, especially with the 2 MBPS to 20 MBPS for all households on demand and capacity to all institutions. The country-wide OFC coverage has also doubled from 700,000 kilometers to 1.4 million cable kilometers, and expenditure on Bharatnet has already crossed the equivalent of around USD 8.5 billion, connecting 197,000 villages.” Discussing upcoming technologies and product developments in optical fiber cables, he mentioned advancements such as micro-cables, rollable ribbon cables, and enhanced-performance fiber units. These innovations contribute to higher fiber density, reduced installation times, and efficient use of existing infrastructure. Mr. Sridharan’s speech also covered emerging technological trends in the telecom industry, including 5G, Wi-Fi 6, artificial intelligence, the Internet of Things (IoT), process automation, cloud computing, and cybersecurity. Mr. Sridharan emphasized the role of these technologies in reshaping the industry and how they are reliant on the optical fiber cable network as a backbone. Furthermore, he addressed the growing market for clean technologies, particularly in the renewable energy sector, and their reliance on the optical fiber cable infrastructure for communication and data management. He ended the speech with a discussion of the global opportunities and challenges faced by the industry. It included insights into the projected growth of the global broadband services market and the increasing relevance of optical fiber cable networks as 6G technology becomes a reality. Notably, the need for greater fiberisation of cell sites was highlighted, and the importance of collaboration between policymakers, regulators, and industry stakeholders was underscored in addressing the industry’s challenges and fostering its growth, “There should be a proper Digitalized map, which can be at the click of a button to know about longitude and latitude, all the GPS coordinates, with everything mapped. Addressing these challenges will require collaboration between the policy maker, that is government, regulators, and industry stakeholders, like us manufacturers, service providers, telecom operators, ISPs, or even the power utility companies”, he added.

Dr. Peter A. Weimann, Chief Technology Officer of HFCL – Optical Fibre and Cable Business, acknowledged the challenges faced by the optical fiber and cable industry in 2023 due to low demand, budget cuts by operators, and global market uncertainties. However, he highlighted reasons for optimism, emphasizing the continuous growth in data traffic, particularly driven by 5G, cloud computing, and artificial intelligence applications, “There are reasons for optimism. The data traffic isn’t slowing down, there are worldwide government schemes to support rural broadband that will need optical fiber, and there’s going to be increased demand for low fiber count cables, for rural distribution and access networks, and also high fiber count cables for metro rings and dense urban applications. Bandwidth growth for the last five years has been growing 29 percent a year, which matched traffic growth on the public networks, which has grown at 30 percent year over year for the past five years. The hyperscale providers are adding cloud regions in places and countries that haven’t had them before. The cloud is coming to Latin America, New Zealand, and Africa because the demand is there. Mobile traffic is increasing at an incredibly high rate as well. 5G is driving a lot of the demand, mobile data growth is projected for the next four years by Ericsson to grow 23% CAGR as people stream more video and do more video calls. Mobile data traffic per smartphone – Congratulations! India is the new world champ. As of this year, India is running about 31 GB per month per phone, the highest rate of bandwidth consumption in the world, higher than the Gulf GCC countries, North America.” Mr. Weimann discussed the expansion of rural broadband initiatives supported by governments worldwide, which would result in a bimodal distribution in fiber counts, “The worldwide government support for rural broadband is going to start to kick in over the next one to four years. In urban areas, there’s demand for high-density, high-fiber count cables for applications like 5G backhaul, cloud, and trunk cables feeding the FTTH network. In rural areas, there’s going to be a need for rugged, low-fiber count cables for FTTH distribution and access, or FTTA distribution and access, in places where they deploy fixed wireless.” This entails an increased demand for both low-fiber count cables for rural areas and high-fiber count cables for urban applications, “People are recognizing broadband as the fourth utility behind power, water, heating, and cooling. Broadband, you can’t live without in modern society.” He cited examples of cable innovations by HFCL to address specific customer pain points, such as developing slim, high-fiber count cables for narrow ducts and providing cost-effective solutions for rural distribution. He concluded by expressing confidence in the industry’s future and HFCL’s commitment to delivering innovative solutions that meet customer needs in a rapidly evolving market, “We have five manufacturing facilities in India. Our campus in Hyderabad is expanding. We’ll be increasing our fiber capacity by a factor of about 1.7 in the next two years. Our facilities in Tamil Nadu have high capacity. We have vertically integrated backward into supplying a lot of our raw materials, and we’re pursuing a cable manufacturing expansion of about 40 percent capacity. HFCL is investing in fiber and cable capacity to cater to both of these applications, both in India and worldwide, and our goal is to work with customers, innovate quickly, and develop solutions that address their pain points.”

Mr. Vipul Nagpal, Founder & Managing Director of Orient Cables India Private Limited, provided an insightful overview of the optical fiber and LAN cable markets, both in India and globally. He highlighted the significant growth and potential in the optical fiber market, with India’s market size expected to reach approximately USD 1 billion by 2028 due to government initiatives, rural penetration, and the demand for data driven by 5G and 6G technologies, “I share the optimism of fellow speakers about the high CAGR and the high volume of optical fiber cables which are expected to be soon in the near future. Today, India’s market size is roughly about half a billion dollars with a projected CAGR of about 10.35%, which means that by 2028, the market is going to be about a billion dollars. This demand comes primarily from government spending and rural penetration. Our PM Modi said that we want to connect 6 lakh villages in the coming future and about 2.2 lakh villages will be connected by the middle of next year. So two-thirds of demand is yet to come. With the 5G and 6G, the demand for data is increasing. The microwave links are going to be replaced with the fiber backbone, so that’s going to be the key driver for optical fiber cables in the coming years. The fiber per capita of the US is about 1.3, and India is less than 0.1, so the scope and the potential for fiber is pretty huge;” globally, the optical fiber market is projected to grow substantially, reaching USD 23.4 billion by 2027. Mr. Nagpal emphasized the vast scope for optical fiber in India, especially when compared to the United States. He also delved into the copper side of telecommunication, noting its more moderate but still considerable growth with a projected size of USD 10 billion in 2032. He discussed the rise of single-pair Ethernet, particularly in the automotive sector, which promises reduced response times and improved cost-effectiveness. Additionally, he shed light on the emergence of Power over Ethernet (PoE) technology, which eliminates the need for separate power connections, streamlines installation, and can deliver up to 100 watts of power, potentially revolutionizing various industries, “The newest technology that’s now becoming prevalent is the single-pair ethernet, which is sort of revolution in networking technology, and the PoE technology. That PoE stands for Power Over Ethernet, which means on a single cable you have power as well as data. A device does not need to have a separate power connection if you connect a PoE networking cable to that. There’s an ease of installation with the PoE technology. The currents are in DC, so you don’t get a shock if you touch it. We are cutting down the cost of installation with the PoE equipment and now because of efficiency a lot of the current requirement of the newest devices is coming down which means more and more devices can start to use a PoE. So current is PoE+ and the newest is PoE++, where PoE+ can transfer about 30 watts of power, and PoE++ can do about 100 watts of power.” Although threats such as private 5G networks exist, these newer technologies provide a silver lining for the LAN cable market, “Of course, there are a lot of threats as well, with the coming of private 5G networks, where the devices, IoT devices are going to be directly connected to a 5G link, OFC terminating directly to the routers. So those kinds of things are killing the overall market for land, but then there’s a silver lining on the cloud. With these newer technologies, we can expect more and more demand coming from copper land cables.” Mr. Nagpal’s speech provided valuable insights into the evolving landscape of optical fiber and LAN cables, highlighting the potential for growth and transformation in these industries.

Mr. Pramod Srivastava, Chief Executive Officer of West Coast Optilinks, shed light on the immense potential and challenges facing India’s optical fiber industry, highlighting the need for a concerted effort to accelerate deployment, standardize products and practices, and invest in a skilled workforce to drive India’s digital transformation and 5G readiness. He addressed the critical role of optical fiber as the backbone of India’s digital growth, focusing on India’s unique position in the global context. He began by emphasizing the enormous demand for optical fiber in India, stating that the country lags significantly behind nations like China, Korea, and Singapore in terms of fiber deployment. Notably, he highlighted that while India is a leading global supplier of optical fiber, its deployment remains flat. Mr. Srivastava underscored the pivotal role of optical fiber infrastructure in enabling 5G connectivity, emphasizing the need for fiberisation of towers, as 5G networks require 30 to 40 times more cell sites. He also noted that true 5G experiences demand 20 to 30 times more fiber than what is currently available. India’s per capita fiber consumption is relatively low, indicating ample growth potential, “As per the Global Fiber Deployment Index, India is just 0.09 fiber kilometers per capita compared to China, Korea, and Singapore, with maybe 10-15 times of India, which indicates that we need a lot of fiber in India. This market as far as India is concerned, in the last three years has remained flat. So there is a demand, but no consumption or deployment is happening in India. The 5G network, the real deployment of optical fiber has not started or begun. So 5G network requires almost 30-40 times more cells than conventional 4G networks. Fiber can support multiple network topology with the highest level of reliability and security means, there has been a lot of technologies being talked about that are going to complement the fiber network but those technologies are not going to replace the fiber network, they are going to coexist actually. The consumption of fiber in the form of production in the last year was 55 million, while only 18 million were consumed in India, and almost 34 million were exported out of India whether it is the US, Europe, Middle East, South East, or Africa market.” He discussed the government’s investment of over USD 13 billion in Bharatnet to promote rural connectivity, which, when implemented, is expected to boost the nation’s GDP by expanding broadband access. Mr. Srivastava then highlighted the challenges and opportunities for the optical fiber industry in India, focusing on standardization of products, deployment practices, and the need for skilled workforces. He pointed out that standardization in product design and deployment practices can significantly improve efficiency, and quality, and reduce costs. He also emphasized the importance of scaling the workforce in the deployment of optical fiber networks, The government has approved over USD 13 billion in investment in terms of Bharatnet, which we call phase two, and phase three, where rural connectivity is going to be enabled, and we all know that there is going to be humongous impact on the nation’s GDP if the broadband connectivity increases. A lot of work needs to be done by industries, policymakers, and who all are involved in this entire ecosystem. The study clearances for the deployment of optical fiber are a key success factor for faster deployment, while the government has taken a lot of initiatives on the ground, the real impact of implementation is yet to be seen. So there is still a lot of gap in interdepartmental coordination, whether it is the forest, whether it is the road, or whether it is the railways. Second, other colleagues on the dais have spoken about the newer technology and newer products that have been developed in this entire fiber ecosystem, but to have a faster deployment it costs a very high level of standardization of the products. The standardization of telecom, the optical fiber cable ecosystem product, whether it is optical fiber cable, whether it is the other passive equipment that goes for the telecom network needs to be standardized. While there has been a certain level of standardization in the underground deployment of a telecom network, whether it is direct burial or inside the duct, if you talk about the area deployment it is highly localized. People are using their techniques, and technologies, if there is no standardization, you don’t get the right skill force.” As the head of West Coast Optilinks, Mr. Srivastava shared the company’s role in the ecosystem. West Coast Optilinks, a part of the SK Bangur group, has over 25 years of experience in the optical fiber cable industry. They operate state-of-the-art manufacturing facilities and are expanding to include an optical fiber draw tower plant. The company supplies optical fiber cables to 25 countries globally and serves a wide range of sectors, including telecom operators, ISPs, railways, defense, and infrastructure. Moreover, they are increasingly focusing on the EPC (Engineering, Procurement, and Construction) business, specializing in the building of optical fiber networks in response to the growing demand for optical fiber infrastructure in India.

Mr. Mukesh Sanghvi, Founder & Managing Director of Indore Composite Private Limited, discussed India’s role in the global manufacturing industry, specifically focusing on the wire and cable sector. He highlighted India’s efforts to become a manufacturing hub, the importance of skilled labor, the need for a complete value chain within the country, and the impact of global localization trends on manufacturing. “The government of India has started a skill mission to develop people in these various skills which is going to be required if we want to be the manufacturing hub of the world. Today, with all this effort, India is the fastest-growing economy.” He also emphasized the significance of innovation and collaboration with customers. Mr. Sanghvi showcased Indore’s innovations in producing various cable materials, including FRP rods, coatings, and strength members. “According to me, innovation always comes in handy. When you do something special, when you do something innovative, you’re recognized at the globe and people come for you. I would say innovation is very, very important. People are looking at value addition and not just cost reduction. This is our global footprint and how Indore has addressed the challenge of countries going local.” Additionally, he emphasized the fact that maintaining a supply chain is very important to compete with companies globally. “So if you notice in our cable industry, we are well-sufficient in our demand and requirement. We have excellent cable producers. We have enough quality fiber producers. There are many raw materials which are produced in India which support this. But as I said, if we want to be really number one or number two in the world, there has to be an entire value chain that is available in India. So we are striving to bring some more raw material for our raw material suppliers in India so that India as a country or entire cable value chain becomes more competitive.” He concludes by acknowledging India’s leadership position in FRP Rod production in the global cable industry. “ I would like to end with one thing. There’s one product in the cable industry, FRP Rods, where India is number one in that product, beating all the countries in terms of quality, in terms of price, service, whatever you say, in terms of innovation. So all the manufacturers of FRP Rod should take pride in that.”

Steel Wire Sector

The 2nd day of the CWF 2023 Conference Conclave was kickstarted by a highly interactive and information-driven panel discussion on Steel Wire Sector. The esteemed panelists on the dais were Mr. Mahesh Poddar – Chairman of Miki Wire Works Private Limited, Mr. Nilesh Paranjape – General Manager of Steel Wire Solutions Business Unit at Bekaert Industries, Mr. Rahul Agarwal – Regional Sales Manager (North) at Tata Steel Global Wires India, Mr. Sidharth Agrawal – Managing Director of Systematic Group of Companies, Mr. Ashish Maheshwari – Managing Director of Bajrang Group, Mr. Ajay Vedmutha – Managing Director of Bedmutha Industries Limited, and Mr. Yashovardhan Chordia – Non-Executive Director of Rajratan Group.

Mr. Sidharth Agrawal steered the panel discussion with an audience address. He expressed gratitude for being part of the event, emphasizing the interactive nature of the discussion. He presented facts about the Steel Wire Manufacturers Association of India (SWMAI), highlighting its status as an apex body for steel wire manufacturers with over 83 members and a mission to position India as a global preferred supplier through innovative technology. Mr. Sidharth Agrawal proceeded to provide data related to the consumption of steel wire rods in India, totaling around 70 million tons, and categorized into mild steel, high carbon, and special steel alloy applications. He further broke down the consumption by region, including north, south, east, and west. Lastly, he shared future projections for the demand in the wire rod industry, expecting an increase from 70 million to 100 million tons by the year 2024.

Post his address Mr. Sidharth Agrawal headed the following panel discussion:

Sidharth Agrawal: So today in this panel, we have all the industry leaders. I would like to throw some kind of insight, and we would like to ask, how do you see the current scenario, and what are the current challenges faced by the industry?

Rahul Agarwal: If I talk about the challenges of the steel wire industry, as is the case with any commodity industry in the country, steel wires are also not immune to the raw metal cyclicity that is there currently. These are dependent on international prices, imports that are coming through, currency fluctuations, government interventions, and other macroeconomic factors. The need of the hour is that the steel wire industry invests in cutting-edge products, and stay ahead of the curve. So, Tata Steel, if I say, we are taking certain initiatives in this regard. Sustainability and having green processes and products for the construction of the automobile industry – is a need of the hour, perhaps, for everyone. It is our responsibility as the established steel wire makers to ensure the future generations’ security is taken care of.

Nilesh Paranjape: There are key megatrends that will define the future of the steel wire industry in India. So from Bekaert’s point of view, we see that three things will change the needs of the end user industry. We as an industry have to bring innovative products to the market to satisfy those emerging needs. The three megatrends – sustainability, number one. The impact that climate change has on various end-user industries, for example, the changing climate conditions has changed the calendar for agriculture and therefore there is a lot of impact on agriculture wires. We also need to look at what is going to happen, and what are the needs of agriculture in the future. Western markets are consumed in protective farming structures, so we should preempt work on those. We do not have those technologies, or process capabilities, those are the main challenges. The third big challenge, or an opportunity, is the whole mega trend of the changing energy basket, energy transition. In the next 10-20 years, we will see a shift from carbon-based energy sources to renewable energy sources. So where does the wire industry stand in those growth areas? Do we have products? Can we look at what is happening in the global industry? What are the wire-based products that are going into these newer energy sources? The market will grow, and the steel consumption will grow – we are at 81 kilos per capita for steel consumption today, and the government wants to take it to 160 kilos per capita. There will be investment in infrastructure, there will be schemes like PLI. Looking at more developed markets and trying to get those technologies into our industry, steel wire industry 2.0. In steel wire industry 1.0, from independence to now, in the last 30-40 years, nothing has changed. There is a need to look at the entire wire portfolio and create an ecosystem, with newer standards from the ministry side and the BIS side to accommodate those newer products. If it was there in the standards it would have been easier.