The company has drafted an investment plan of INR 200 crores in phased manner for optical fibre cable manufacturing, followed by expansion of similar capacity in next 2 years.

Wire & Cable India interviewed Mr. Rajesh Pania, COO, Corsis Technologies (Pratap Digital Communications Pvt. Ltd.) wherein he delves in about the core capabilities of the company, their infrastructure setup, its new venture- Corsis Technologies, the outlook on the Government’s initiatives to strengthen the optical fiber cable network and the telecommunication industry, and their future plans.

Wire & Cable India: Please tell us about Pratap Group, its product portfolio and the business journey so far?

Rajesh Pania: Pratap Group was established in the year 1987. Since its inception, the company has evolved and diversified into multiple business domains across geographies. Currently, we are the market leader in the telecom service industry and fibre cable manufacturing is an extension to Groups’ existing business domain under our flagship organization – Pratap Technocrats Pvt. Ltd. which was established in the year 1998.

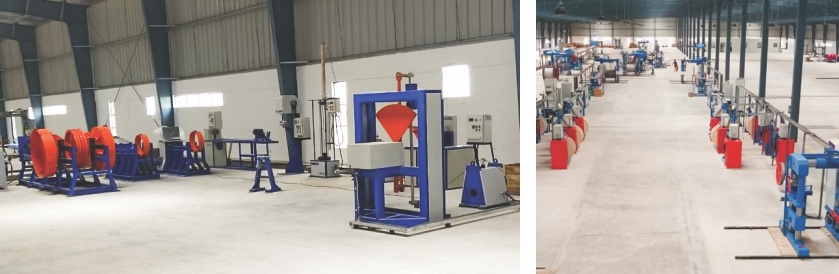

We manufacture a wide range of optical fibre cables – armoured, unarmoured, simplex, duplex and FTTH/drop cables. Recently, Pratap Digital Communications Pvt. Ltd., a Pratap Group of company, came up with its new venture into manufacturing of optical fibre cable with a world class set up in Pithampur, near Indore in Madhya Pradesh. In this facility, we will manufacture around 70000 Kms of fibre cables annually with the existing set of machines.

Our new venture – Corsis Technologies is a subdivision of Pratap Digital Communications Pvt. Ltd. This new OFC plant in Indore has been commissioned with indigenously manufactured machine setup barring some testing machines.

WCI: Could you tell us about your infrastructure, workforce, manufacturing capabilities and production capacity?

RP: Our facility is situated around 56 Kms from the commercial Capital of Madhya Pradesh, Indore. It is located at Smart Industrial Park in Pithampur, which is currently under the development stage by MPIDC. We have a strong overall strength of more than 15000 employees. We cater to our overall clientele base of around 65 renowned companies in India with overall presence in 22 states in India. Under the current infrastructure setup, we can produce more than 1,00,000 Kms of fibre cable per year.

WCI: Congratulations for the start of commercial production at Pratap Group’s new OFC plant in Indore. Could you shed some light on the company’s new venture (Corsis Technologies), production capacity, infrastructure setup, technology and machine suppliers etc.?

RP: Our new venture – Corsis Technologies is a subdivision of Pratap Digital Communications Pvt. Ltd. This new OFC plant in Indore has been commissioned with indigenously manufactured machine setup barring some testing machines. Keeping in mind the ‘Make in India’ initiative as envisioned by our honorable Prime Minister, we procure raw materials thoroughly from the domestic suppliers. We have built a state-of-the-art facility to manufacture products at par with global quality standards.

In addition, I would like to underline the fact that Pratap Technocrat is India’s only project management service provider with biggest portfolio of managing towers and fibre in both urban and rural sectors.

WCI: What are your views on the government’s ‘Digital India’ initiative and how do you relate its contribution to the Telecommunication industry? Also, please share your thoughts and plans regarding the Optical Fiber segment.

RP: We are excited about the Digital India program envisioned by the Government of India and we’ve been looking forward to contribute for the same by making our infrastructure ready to serve the mission. Recently, our Prime Minister Narendra Modi has declared that around 1 lakh villages will be connected through optical fibre network in 1000 days.

There is a huge market potential in fibre manufacturing and existing business to support such order book. With high internal demand for fibre cables, Pratap Group being one of the largest O&M service partner in this domain will be able to suffice the initial production state. Moreover, with high penetration in most of the Telcos and IP, there are high chances for efficient and productive sales and marketing. Also, competitive cost bidding in turnkey projects, i.e. S&I with O&M, can be a catalyst in business growth. High demand and low supply makes the fibre production a rewarding option for us. In addition, the expansion in fibre manufacturing will provide us a great scope for growing into new avenues outside India as well. We are specifically targeting developing and under developed nations.

WCI: What kind of investment is India expecting in the optical fibre cable network infrastructure in the coming years? Where do you place yourself in this growth story of optical fibre networking?

RP: The global OFC Market was valued at USD 3477 million in 2017, and is projected to reach USD 8153 million by 2025, growing at a CAGR of 11.6% to 12.26% from 2018 to 2025. The fastest growing market is Asia-Pacific region, predominantly India and China. Moreover, the 5G connections (excluding IoT) are anticipated to reach USD 670 million in Asia-Pacific by 2025. India is the fastest growing market in APAC with CAGR of 36% from FY 11 to FY19.

Looking at the trend, the OFC market in India is projected to reach USD 424 million by 2021. The Indian optical fibre cable (OFC) market stood at USD 881.5 million in 2019 and is projected to grow at a CAGR of 19.7% to reach USD 2.1 billion by 2024. Thus, with such anticipated investments in the sector, there are ample opportunities lying on the canvas for us in the coming years.

WCI: What measures and steps are being taken by the optical fibre cable makers to secure a long-term supply of optical fibre to meet the rising demand from the network providers?

RP: From 2013 to 2019, there has been around 200% increase in demand in the optical fibre cable. There is a 3-fold increase in production of optic fibre in India, however, the total fibre consumption is still >5% of global production. With the Government’s initiatives and some of the key private players investing in optical fibre network, the future demand by 2022 will be 30 million Kms. Smart cities will turn out to be as the major procurement hubs for optical fibre cables. Apart from the laying of new fibre networks, there are also potential existing customers for renewing fibre in damaged sections. To meet this demand, the current production capacity needs to be at least doubled. There is a great scope in markets to entertain new players in the field of fibre manufacturing.

Beckhaul Technologies, another wing of Pratap Group, has partnered with the Indian Government under the BharatNet programme… eying a huge OFC network estimated to ~ 0.7 million Kms.

WCI: Keeping in mind the impact of the COVID-19 pandemic on industries, what kind of market trends do you foresee in the current FY and the next FY?

RP: With high demand for internet connectivity, the demand for optical fibre will sustain post-COVID. However, the current situation should serve as a warning. India could have been better prepared had a rapid fibre optic network been deployed as envisioned in the National Digital Communications Policy 2018. India’s internet consumption rose by 13% since the nationwide lockdown was put in place to check the spread of COVID-19. According to the Department of Telecommunications – Ministry of Communications, on an average, Indians consumed 308 petabytes (PB) or 308,000 terabytes (TB) of data daily. With this trend, we are positive that the OFC market will witness a surging market push in the coming years.

WCI: What are your future plans with regard to any kind of investments in the plant, product development, market reach etc?

RP: There is a huge potential for optical fibre market in India. Between 2014 to 2020, the OFC deployment by the Indian telecom operators have grown to 1 million Km to close 1.6 million Km. Keeping in mind the scope of OFC in India, we have drafted an investment plan of more than INR 200 crores in phased manner for optical fiber cable manufacturing, which will be followed by expansion of similar capacity in next 2 years and then followed by draw fibre plant. Our startup unit has already started working on the development of new products based on fiber optic technology.

As far as the reach is concerned, our target customer segments are telecom operators and players such as L&T, PGCIL, RailTel, GAIL, and defense for the supply of OFC cables. Also, the MSO/ISO/Cable/DTH operators are in our target business opportunity areas, who are investing upon the last mile connectivity.

Beckhaul Technologies, another wing of Pratap Group, has partnered with the Indian Government under the BharatNet programme – which is the largest rural telecom network, eying a huge OFC network estimated to ~ 0.7 million Kms. Pratap Group is looking for long term opportunities in joint ventures through Beckhaul Technologies as well.

WCI: Is there anything else you would like to add?

RP: The telecom penetration is expected in both the urban as well as rural areas of India. There will be a very high demand of optical fibre forecasted for this massive expansion. Data consumption will keep growing exponentially with the availability of new technologies such as 5G. Moreover, the Government’s initiatives such as Digital India, Smart Cities Mission and National Optical Fibre Network, coupled with growing investments in data centers and increasing popularity of FTTH (Fibre to the Home) will drive the India optical fibre market through 2023.

To deliver internet reliably and deliver bandwidth-hungry applications such as live-streaming online coaching classes, an optical fibre cable is the most suitable medium for carrying high amount of data over long distances. Indian optical fibre cable (OFC) market is expected to grow robustly due to the expansion of telecom infrastructure throughout the country over the next five years.

The Government’s initiatives such as Digital India, Smart Cities Mission and National Optical Fibre Network, coupled with growing investments in data centers and increasing popularity of FTTH (Fibre to the Home) will drive the India optical fibre market through 2023.

Being the second largest telecom market worldwide, India exhibits high data traffic owing to increasing penetration of smart phones and growing demand for broadband services, thereby creating significant demand for OFC installations. While there is a huge demand of OFC cables, there is a shortage of supply leading to export of product and increase in cost and delay in project deliveries. Moreover, the Government is currently focusing on smart cities solution and huge investment is lined up in this area.